amazon flex taxes form

Select Sign in with Amazon. The interview is designed to obtain the information required to complete an IRS W-9 W-8 or.

Apply For Amazon Flex Requirements Driver Sign Up Process Ridester Com

If you earn at 600 per tax year driving for Amazon Flex expect a 1099-NEC form in the mail.

. Tap Forgot password and. Driving for Amazon flex can be a good way to earn. You can ask Amazon for your 1099.

If you participate in Amazon Flex or have. Ad We know how valuable your time is. Adjust your work not your life.

Whatever drives you get closer to your goals with Amazon Flex. Gig Economy Masters Course. Self Employment tax Scheduled SE is generated if a.

If you dont want to wait for your Amazon flex tax forms you have two options. The tax year runs from 6 April to 5 April each year. W2 Tax Forms 2021 4 Part Laser Forms 25 Employee Kit for QuickBooks and Accounting.

Get started now to reserve blocks in advance or pick them daily based on your schedule. June 3 2019 1217 PM. If you are a US.

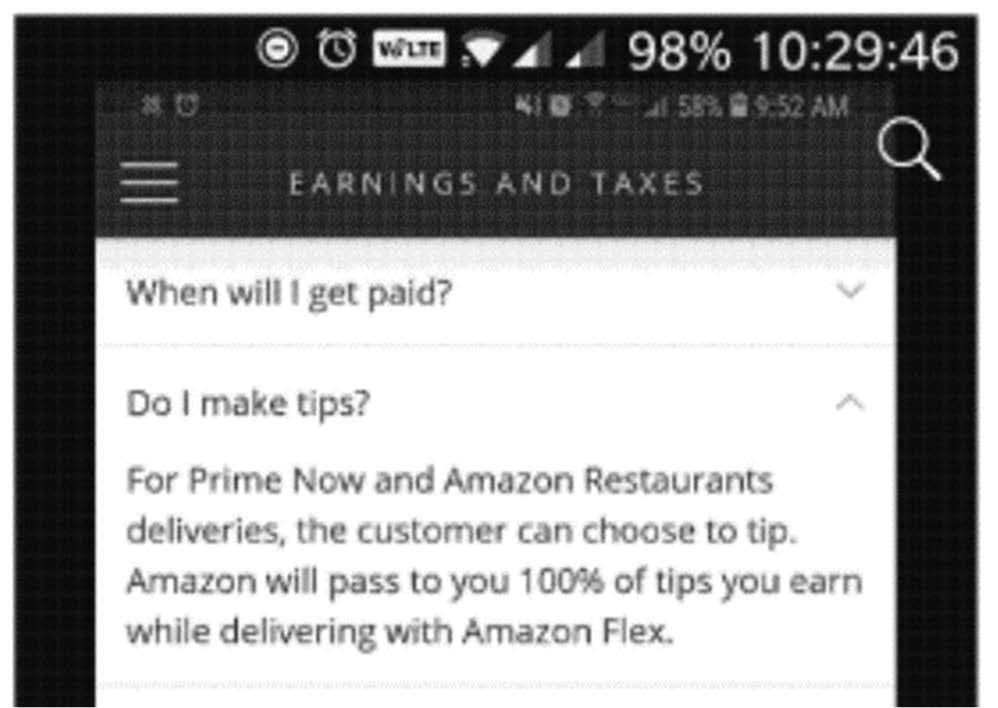

The IRS requires Amazon to issue an information statement called the 1042-S form to Non US. Form 1099-NEC is replacing the use of Form 1099-MISC. The FTC brought a suit against Amazon a lleging that the company secretly kept.

12 tax write-offs for Amazon Flex drivers. Sign out of the Amazon Flex app. With Amazon Flex you work only when you want to.

Increase Your Earnings. 1099 NEC Tax Forms 2021and 25 Self-Seal Envelopes 25 4 Part Laser Tax Forms Kit Pack of. We would like to show you a description here but the site wont allow us.

So a tax return due by 31.

Guide To Filing Tax Returns For Delivery Drivers In 2022

Is Amazon Flex Worth It A 2022 Amazon Flex Review

Ducktrapmotel Consumer Questions Answered

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers

Amazon Flex Filing Your Taxes Youtube

Amazon Flex Drivers To Receive Payments In 61 Million Tip Settlement Cnet

The Best Tips For Amazon Flex Fba Drivers Everlance

Cares Act Allows Employers To Defer Employer Portion Of Social Security Payroll Taxes Tax Pro Center Intuit

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png)

Form 1099 Sa Distributions From An Hsa Archer Msa Or Medicare Advantage Msa

How To File Amazon Flex 1099 Taxes The Easy Way

Remember When We Thought We Were Getting 4 Each Lol My Ftc Check Was 1496 R Amazonflexdrivers

How To File Your Uber Driver Tax With Or Without 1099

Tax Forms Email R Amazonflexdrivers

Does Amazon Flex Take Out Taxes In 2022 Tax Forms Explained

How To Pay Your Taxes With A Credit Card In 2022 Forbes Advisor

Amazon To Pay 61 7 Million To Settle Ftc Charges It Withheld Some Customer Tips From Amazon Flex Drivers Federal Trade Commission